Novidam was founded in New York City on January 10th, 2014.

Following an entrepreneurial model known as a Search Fund, twenty new investors were convinced to partner on a journey to go out and find, acquire, and grow, one privately held company. In 2016 the first company (security and fire alarm business) was acquired with private equity and debt capital. Novidam’s Founder the company’s CEO and together with a experienced Board of Directors, grew the business fifteen fold, from organic initiatives and more than ten subsequent acquisitions - becoming the regional leader. A significant piece of our investment holdings was realized in 2022, creating outsized returns for Limited Partners and Novidam. Over the years, Novidam diversified further and was built out to today’s investment firm, partnering with exceptional CEO’s and entrepreneurs - in multiple industries with similar economic characteristics, and, across the globe.

Throughout our trajectory, we’ve kept identifying unique talent and deeply studying niche industries.

We like to think. In 2024, we hold a diverse global portfolio in business services and (light) technology companies. Investments are structured as Search Funds, direct Private Equity, or Long Term Holds (the latter participated in through our Family Office vehicle). We do our best to connect with proven leaders at top-tier MBA programs and partner with with the best in their respective niches. We have three offices in different locations, enabling close interactions with our leaders and our businesses. We still believe in traditional face to face work. For us, building a great business with special CEO’s and their teams, is something like running a marathon – it is certainly not a sprint. We plan ahead, try not too start too fast, and when we see a special opportunity, collaboratively engage to seize it.

Our DNA is Search Funds.

Search Funds are unique and have become a sizable investment asset class, where together with the CEO’s we support, we provide selling company owners a one of a kind succession solution. Search Funds are vehicles in which a Searcher is looking to find, acquire and grow, one great business. Search funds seek out company owners who might not want to sell to a traditional investment firm, or to the competitor they’ve been fighting all those years. That type Buyer might take the owner’s company’s name off the well. A Search Fund however provides a Seller fresh capital, and, a fresh, hungry, exceptional individual, willing to roll up her or his sleeves and learn. In a Search Fund, the Searcher becomes the CEO and is groomed to take over the day to day of leading a business (usually, after a transition period where the Seller and new CEO work together closely).

With a Search Fund, a selling entrepreneur finds a good home for her/his business and its people, and an aspiring new entrepreneur finds a great business to grow for the long run - creating wealth for shareholders and for her/himself and family. Novidam has lived this journey and subsequently helps select the best search entrepreneurs, providing tools to help them find exceptional companies. Next, we actively assist in the growth phase, to create long lasting companies and financial returns.

For aspiring searchers; with Novidam, you are in charge of decision making and long term strategy — we have no defined holding periods. For selling owners; our Search Fund entrepreneurs are here to preserve the legacy you’ve built – we offer strong company valuations and it is our sincere intent to keep your company’s long lasting name on the wall.

We go deep with Private Equity

At a certain phase in a company’s evolution, liquidity may be sought, or an industry specific Buyer might be preferred, for continued specialism, growth, or capital. Here too, we invest for the long run. Novidam has the flexibility to take majority or fully owned stakes in select companies. This is different from our Search Fund approach and an investment class we participate in on a case by case basis. In our history, we’ve executed in Private Equity when an opportunity presented itself without a searcher, or, through an existing management team wanting to perform a management-buy-in, or, where we founded a new business.

We are an entrepreneurial investment firm with a ‘can do’ ethos. In Private Equity opportunities, these instances we gather industry specialism from outside as well and potentially hire an experienced CEO, to allow for a balanced risk profile. In our Private Equity investments we work ultra-closely with CEO’s and their Management Teams to provide strategic help, access to (debt) capital markets and to further M&A, leveraging our network and compounding financial returns for partners for the longer run.

We invest in select Long Term Hold journeys through our Family Office

Here, we acquire businesses or partner with other investors to collaboratively acquire a number of complementary businesses, with the goal of supporting entrepreneurs who intend to spend longer periods acquiring and merging a select group. These businesses can be in the same industry and globally complementary, or, in alternative industries but after being integrated, stronger, with more dense customer bases operated as a whole.

Most of our Long Term Hold investments are in software niches, or specific niches in business services. The common features among our investments here are very low churn rates, fast growth curves with some history, and crystal clear value propositions with ‘rights-to-wins’.

Entrepreneurs we work with are true visionaries and business builders, who in relatively early career paths hold long forward perspectives for what they intend to create. Their personal goals play a significant part here and we take them into account thoroughly when creating strategies. These CEO’s care about finding the right investment partners where goals around longevity, talent acquisition, strategic M&A, and creating regional density through consolidation, are aligned.

Across our investment types, our businesses share important key criteria

Long-term recurring revenues

Positive net revenue retention profiles

Low churn rates

High and sustainable operating margins

Operating profit between ~2-10m EBITDA

History of growth and industry growth tailwinds

Critical service in niche industries

At Novidam, we’ve lived the operating grind with a special team -and we love the world.

We know the work ahead is very challenging and affects all aspects in life. We can help think through that. And even though we believe in focus, we don’t believe in sticking to just one geography.

We believe the way prospective entrepreneurs think about ‘type investors’, in Search Funds and Private Equity, is too siloed. Potential investors get a label of Capital Allocator, or Operator/Entrepreneur. But companies need both. CEO’s want diversified cap tables - which have enough ‘funds’, enough ‘investors who know much about deals’, and, enough ‘operators’. Yes, you want that. But what you need is time from your partners. And a working relationship in which you dare to pick up the phone to ask the supposed dumb questions. And they don’t exist.

Novidam’s people have lived each phase of the entrepreneurial finance journey, deeply. Including the pains. We’ve lived the risk of starting businesses from nothing and finding the little first bit of capital, (Prudential Tower, Boston MA, 2014). Next, the stress and endless grind of finding a proper business while working tirelessly with Sellers and crafting a relationship (with the key LOI expiring multiple times pre-close, 2015). The phase and the delicacy of closing a deal, while at the same time raising Seller Debt and managing expectations of a Selling Entrepreneur, 2016. Putting together Senior Lender and Mezz Lender financing, critically assessing covenants without knowing the business (2015, 2017, 2019, 2022). Finalizing a cap table and recruiting a Board of Directors (getting that right is so important!). Next, working with them, navigating Board Meetings. Refinancing balance sheets incl. difficult bank ‘work-out-groups’ and acquiring competitor companies from lender hostility in times of equity distress (multiple occasions). Regional M&A, financing and integration of tuck-ins (>10x). Operating a business and leading teams (throughout – the most difficult and stressful piece). Raising equity for long-term and short-term M&A (2016, 2017, 2022). Selling a group of companies somewhat unexpectedly and unplanned, an overwhelming undertaking (2022). Sound intriguing?

With us, you have people in your corner who have lived most experiences of your upcoming or present journey. We know what it’s like to roll up our sleeves. First time CEO’s often struggle to ask questions. ‘You’re managing others’ money after all, you need to know everything’. You don’t. We want to hear those questions and collaborate with you. The Search Fund world is about collaboration and alignment. Each improvement and small detail shared, to problem-solve together, benefits all stakeholders.

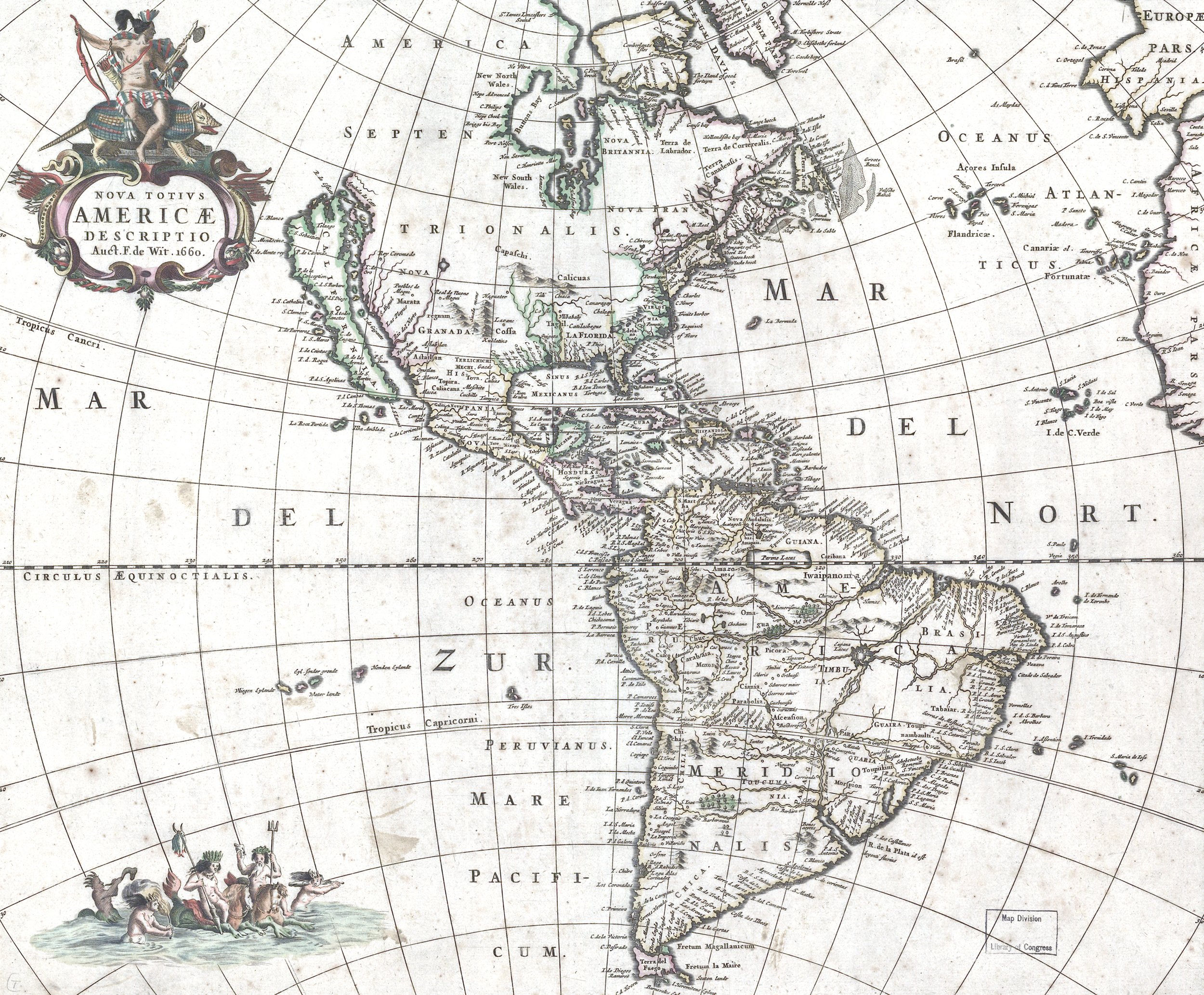

We are global investors. Our invested capital weight, from an investment portfolio standpoint, is geared to the United States. With Europe as a close second. But we do not discriminate anywhere, geographically. We have companies and searchers in Southeast Asia as well as in Latin America (2023). In new or less active search fund regions (be it for limited lender capacity, higher interest rates, floating exchange rates, different educational backgrounds of talents, or smaller TAM’s, we opportunistically assess next will approach with extra rigor. But we don’t shy away. In sound macro-economic climates and where we can perform thorough due diligence, we believe the drivers of successful long term returns come mostly from the unique combination of the right entrepreneur and the right business. In the right niche.

We have significant Assets Under Management outside the United States, which we structure into our three investment segments (Search Funds, Private Equity, Long Term Holds), with responsibilities and governance separated. We have active team members to help our companies flourish in offices in New York, London and Amsterdam.

Novidam by the numbers

15

Investments in

countries

18

Searchers in

countries

45

We share

years in investing and consulting SME’s

8

We hold

active BoD seats at a given time, where time is actively created

4

We have

investment committee members, each with (co-)investment opportunity, aligning risk and return

20

We partner with

of the most experienced search fund investors and partners going back to the founding of the model