Novidam is a global Investment Firm, partnering with the best entrepreneurs and their companies

Founded in New York City on January 10th 2014, following an entrepreneurial model known as a Search Fund, our Founder convinced twenty - priorly unknown to him - investors to partner in a business venture. The goal was a journey to find, acquire, and grow, one privately held company. In January 7th 2016, the first company (a small security and fire alarm business) was acquired. Novidam’s Founder became CEO of the company and together with an experienced Board of Directors, the business was grown fifteen fold the next six years. Organic initiatives and ten regional acquisitions contributed to the fast growth, the company becoming the regional leader.

Novidam and investors exited the initial company position in 2022, creating outsized returns for its Limited Partners and Novidam. Since and through 2024, Novidam has backed one hundred search funds, invested in twenty companies and acquired or co-founded four direct wholly owned companies.

Over the years, Novidam was built out to today’s global investment firm, partnering with exceptional CEO’s and entrepreneurs. In 2025, through our third fund, we are active in multiple industries with similar economic characteristics - across the globe.

Throughout, we’ve kept identifying talent by deeply studying niche industries and their best performers

Novidam is closely linked to the academic world. It’s where we find our talent, our deals, our peers. In 2025, we hold a diverse global portfolio of positions in business services and (light) technology companies. Investments are structured as Search Funds or wholly owned Private Equity companies. We also participate in ‘Long Term Holds’ through a separate Family Office vehicle.

We aim to connect with proven leaders at top-tier MBA programs, working together with them in companies in their respective niches. We have people in three offices in different locations, enabling close interactions with our leaders and businesses. We believe in traditional face to face work and for us, building great businesses with CEO’s and their teams, is like running a marathon – not a sprint. We plan ahead, try to start slow and collaborate. When we see a special opportunity, we engage and aim to seize it.

Our DNA is our Search Funds Practice.

Search Funds are unique and have become a sizable investment asset class, where together with the CEO’s we support, we provide selling company owners a one of a kind succession solution. Search Funds are vehicles in which a Searcher is looking to find, acquire and grow, one great business. Search funds seek out company owners who might not want to sell to a traditional investment firm, or to the competitor they’ve been fighting all those years. That type Buyer might take the owner’s company’s name off the well. A Search Fund however provides a Seller fresh capital, and, a fresh, hungry, exceptional individual, willing to roll up her or his sleeves and learn. In a Search Fund, the Searcher becomes the CEO and is groomed to take over the day to day of leading a business (usually, after a transition period where the Seller and new CEO work together closely).

With a Search Fund, a selling entrepreneur finds a good home for her/his business and its people, and an aspiring new entrepreneur finds a great business to grow for the long run - creating wealth for shareholders and for her/himself and family. Novidam has lived this journey and subsequently helps select the best search entrepreneurs, providing tools to help them find exceptional companies. Next, we actively assist in the growth phase, to create long lasting companies and financial returns.

For aspiring searchers; with Novidam, you are in charge of decision making and long term strategy — we have no defined holding periods. For selling owners; our Search Fund entrepreneurs are here to preserve the legacy you’ve built – we offer strong company valuations and it is our sincere intent to keep your company’s long lasting name on the wall.

We go deep in our Private Equity Practice

At a certain phase in a company’s evolution, liquidity may be sought, or an industry specific Buyer might be preferred, for continued specialism, growth, or capital. Here too, we invest for the long run. Novidam has the flexibility to take majority or fully owned stakes in select companies. We’ve also founded them. These approaches are different from our Search Fund approach and an investment class we participate in on a case by case basis. In our history, we’ve executed in Private Equity when an opportunity presented itself without a searcher, or, through an existing management team wanting to perform a management-buy-in, or, where we founded a new business.

We are an entrepreneurial investment firm with a ‘can do’ ethos. In Private Equity opportunities, these instances we gather industry specialism from outside as well and potentially hire an experienced CEO, to allow for a balanced risk profile. In our Private Equity investments we work ultra-closely with CEO’s and their Management Teams to provide strategic help, access to (debt) capital markets and to further M&A, leveraging our network and compounding financial returns for partners for the longer run.

We invest in highly selective Long Term Hold journeys through our Family Office

Here, we acquire businesses or partner with other investors to collaboratively acquire a number of complementary businesses over time, with the goal of supporting entrepreneurs who intend to spend longer periods acquiring and merging a select group. These businesses can be in the same industry and globally complementary, or, in alternative industries but after being integrated, stronger, with more dense customer bases operated as a whole.

Most of our Long Term Hold investments are in software niches, or specific niches in business services. The common features among our investments here are very low churn rates, fast growth curves with some history, and crystal clear value propositions with ‘rights-to-wins’.

Entrepreneurs we work with are true visionaries and business builders, who in relatively early career paths hold long forward perspectives for what they intend to create. Their personal goals play a significant part here and we take them into account thoroughly when creating strategies. These CEO’s care about finding the right investment partners where goals around longevity, talent acquisition, strategic M&A, and creating regional density through consolidation, are aligned.

Across our investment types, our businesses share important key criteria

Long-term recurring revenues

Positive net revenue retention profiles

Low churn rates

High and sustainable operating margins

Operating profit between ~2-10m EBITDA

History of growth and industry growth tailwinds

Critical service in niche industries

We are entrepreneurs and have lived the grind of operating companies

We know that the work ahead, for aspiring entrepreneurs, is very challenging. Running companies (and the responsibilities that come with it) affects all aspects in life. We understand…and we can help people through

As a prospective entrepreneur, you’re thinking about what ‘different type investors’ exist and might be helpful. Investors get a label of being a Capital Allocator, or, a former Operator/Entrepreneur, or, ‘a Fund’. Sure, a diversified capitalization table includes it all - ‘Funds with deep pockets for M&A’, ‘Investors who know much about deals’, and, ‘Operators’. But what you actually need from your Investors…..is Time. The secret sauce of Search Funds and Private Equity teams, is collaboration. You want a working relationship in which you dare to pick up the phone, to ask supposed ‘dumb’ questions. At Novidam, dumb questions don’t exist.

Novidam’s people have lived each phase of the entrepreneurial journey, deeply. Including the pains.

We’ve lived the risk of entrepreneurs’ next steps of starting businesses from nothing and finding the little first bit of capital. Next, the stress and endless grind of finding a proper business while working tirelessly with Sellers and crafting a relationship (with key LOI’s expiring multiple times pre-close). Thenm the phase and the delicacies with Sellers of closing a deal, while at the same time raising Seller Debt and managing expectations of that same Selling Entrepreneur. At the same time, putting together Senior Debt and Mezz financing, keeping the deal attractive while critically modeling covenants. Lastly, we’ve frequently experienced finalizing the ‘perfect’ cap table and recruiting a complementary Board of Directors - actively working with them and navigating thoughtful Board Meetings and Executive Sessions.

While operating, we’ve refinanced balance sheets including bank hired ‘work-out-groups’. We’ve acquired competitor companies from lender hostility, in times of equity distress. We’ve executed a programmatic and intentional M&A strategy; financing and integrating tuck-ins (>10x and with deals in excess of $200m). We’ve led teams and parted with them, we’ve raised long term and short term equity instruments, we’ve acquired and divested across the globe.

If a partnership sounds intriguing, we’d love to hear from you. With Novidam, you have people in your corner who have lived most experiences of your upcoming or your present entrepreneurial journey. Each improvement and small detail shared, to problem-solve together, benefits all stakeholders.

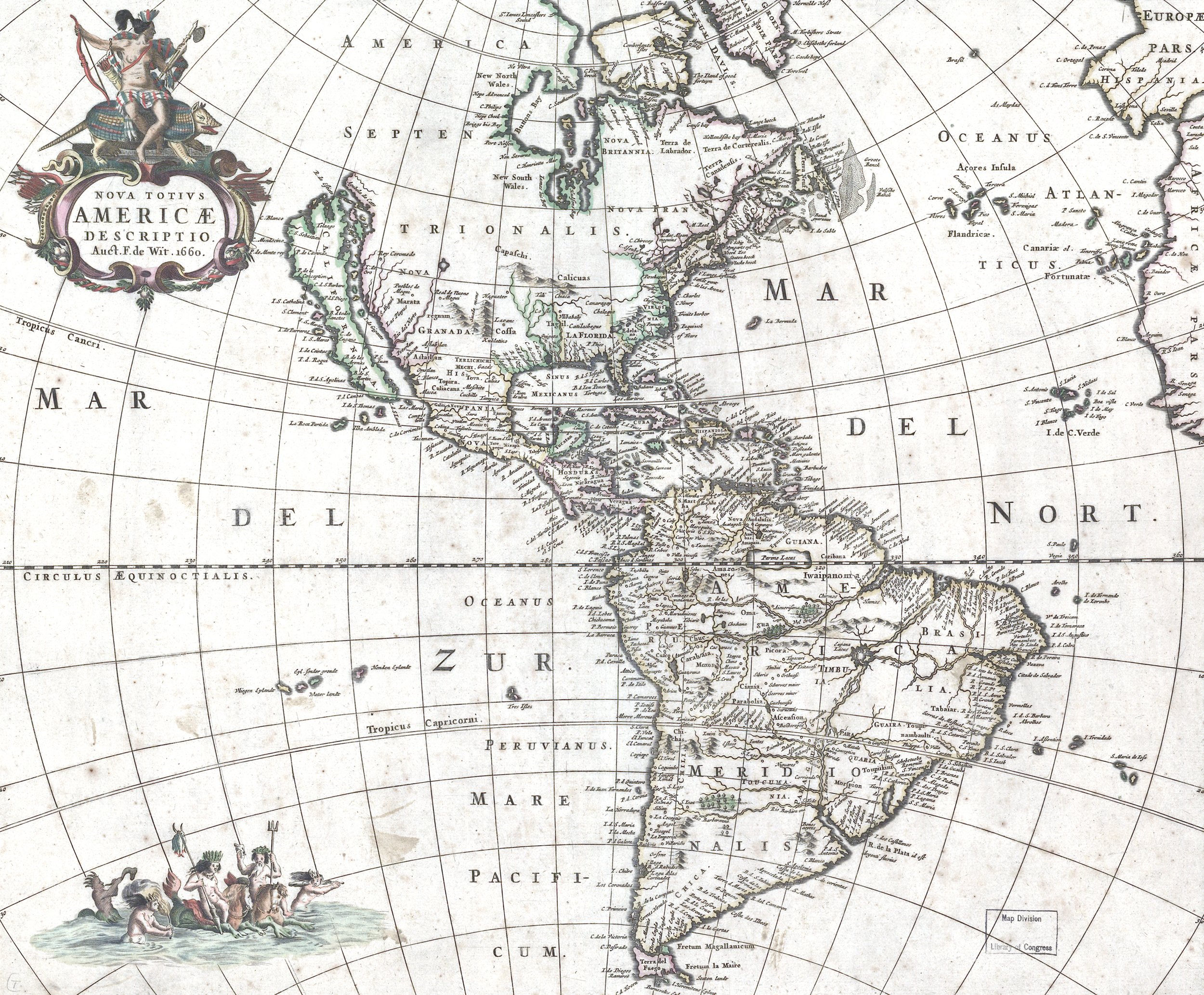

We are global investors. Our invested capital is weighted to the United States, with a growing portion rest of world (Europe leading). We don’t discriminate geographically. We have companies and searchers in North and South America, Europe, and Asia. With ~ 100 search funds and ~30 acquired businesses in 2025, with many still searching, our portfolio will become more flobal. In newer or less active search fund regions (be it for limited lender capacity, higher interest rates, floating exchange rates, different educational backgrounds of talents, or smaller TAM’s), we opportunistically assess (perhaps with extra rigor). But we don’t shy away. In sound, growing macro-economic climates, where we can perform thorough due diligence tactics, we believe the drivers of high long term returns will come. They come mostly from the unique combination of the right entrepreneur with the right business, with the right help and in the right industry niche.

We have significant Assets Under Management in Search Funds, direct Private Equity and in Long Term Holds - with a team waiting to help our companies flourish in offices in New York, Amsterdam and London.

Novidam by the numbers

Invested in

21

Investments in

countries

100

Search Funds

45

We share

years in investing and consulting SME’s

9

We hold

active BoD seats at a given time, where time is actively created

4

We have

investment committee members, each with (co-)investment opportunity, aligning risk and return

20

We partner with

of the most experienced search fund investors and partners going back to the founding of the model